In Poland, “data” is no longer a buzzword; it is a hiring strategy. Banks, retailers, tech firms, shared service centres, BPOs, and manufacturers are all trying to squeeze more value from the numbers they already hold. That shift has pushed data & analytics specialists to the centre of the labour market.

In 2025, Poland’s tech hiring rebounded strongly, with IT vacancies up approximately 68% year-on-year. Data-focused roles now represent around 9-10% of all tech job advertisements, making them the largest specialist category on some platforms. Put simply, if a company is serious about digital transformation, it is hiring data talent.

Does the available data explain why data & analytics specialists are in high demand in Poland today? Let’s find out.

Why Data and Analytics Are Becoming Core to Business in Poland

Until recently, many Polish companies treated analytics as a supporting function which was useful for reporting, but not critical for growth. That perception has shifted decisively.

Business-services hubs in Warsaw, Krakow, Wroclaw and Tricity now host regional and global analytics teams serving finance, fast-moving consumer goods (FMCG), pharma, e-commerce and logistics organisations. According to ABSL, Poland’s business services sector employs more than 450,000 people, with a growing share working in data, BI and automation roles rather than purely transactional work.

The shift is clearly visible to recruiters. Senior IT Recruitment Expert at Verita HR Group, Milena Górka, notes, “the data and analytics market in Poland is growing fast, and this can be seen in talks with both candidates and employers. Just two years ago, many companies saw analytics as something extra. Today, they are building full teams and searching for experts who can connect technology with business needs.”

The Data Analytics Trend is Growing

Verita HR’s 2025 analysis of tech hiring confirms this trend. BI analysts, data engineers and big-data specialists now account for close to one in ten IT vacancies in Poland. At the time of the study, there were approximately 200 live data and analytics roles nationwide. Warsaw accounted for around 100 of these, driven by employers such as CloudPay, Nielsen, EPAM Systems, Deloitte, PwC Poland, and Siemens Energy. Krakow followed with roughly 75 openings, supported by firms including UBS, Capgemini, GE HealthCare, Cognizant, and GlobalLogic. Wroclaw listed close to 30 roles, with demand from companies such as PwC Poland, AXA XL, ALTEN, UBS, and CloudPay.

As Milena adds, “we also see companies changing how they design their data teams…creating integrated groups where analysts, engineers, and reporting specialists work together. This raises the bar for candidates, …and gives these teams stronger influence on business decisions.”

Crucially, demand is no longer confined to technology-driven organisations. Banks use risk and customer-behaviour models to protect margins. Retail and e-commerce players use data teams to optimise pricing and recommendation engines in real time. Manufacturing firms rely on plant-level analytics to cut downtime and energy costs. In each case, analytics is no longer an abstract capability but a core operational tool that directly influences commercial outcomes.

Rising Salaries and Tight Competition in Poland’s Data Analytics Market

On paper, Poland has thousands of professionals with “data analyst” or “BI analyst” on their CVs. In practice, far fewer can move confidently between SQL, Python, dashboards, and senior business stakeholders. This skill gap is where market pressure is most acute.

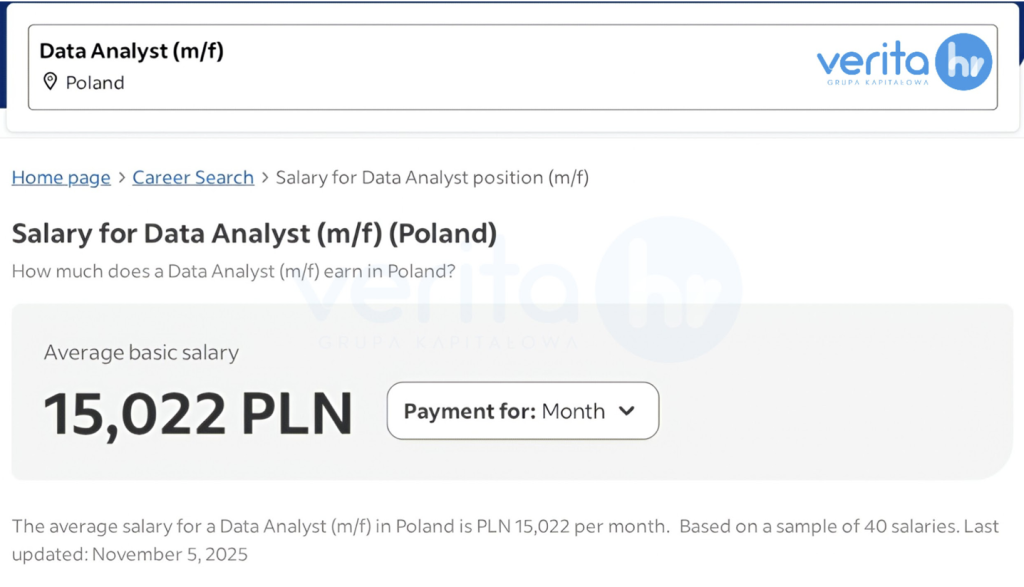

Public salary data reflects this imbalance. Indeed’s latest figures show average monthly pay of approximately PLN 15,000 gross for a data analyst role in Poland. A recent Bulldogjob-based summary of IT wages places data analysts with foreign-language skills at around PLN 9,000 gross, highlighting how international projects and English or German fluency continue to drive salary premiums. Broader compensation research estimates that the average annual salary for a Business Intelligence Analyst at roughly PLN 225,000, with senior professionals earning well above this level.

Verita HR’s “Top 10 Tech Roles” review notes that pay inflation is accelerating at the senior end of the market. Salaries for experienced data and analytics professionals have risen by more than 15% since early 2024, indicating that employers are competing directly for proven capability rather than simply expanding junior teams. Companies increasingly recognise that a strong data hire can materially impact costs, revenue, and decision-making, and they are pricing that value accordingly.

Key Skills and Expectations Polish Employers Seek in Data Specialists

Job titles range from Data Analyst and BI Specialist to Data Engineer and Analytics Consultant, but Polish employers are converging on the same expectations: a blend of three essential capabilities delivered in one professional.

First, polish employers expect solid technical foundations. SQL is still mandatory. Python or R, modern BI tools such as Power BI or Tableau, and experience with cloud platforms like Azure or AWS are now standard requirements in most mid- to senior-level roles.

Second, the ability to translate business questions into data questions. A retail CFO does not ask for “a new data model,” they ask why margins dropped last quarter. The strongest specialists can frame the right question, build the analysis, and explain the outcome in clear, non technical language.

Third, domain understanding. For example, in banking, employers require a comprehensive knowledge of credit risk, fraud, and regulatory reporting. Polish companies have learned, often through costly mis-hires, that generic analytics skills are no longer sufficient. Increasingly, they screen for sector knowledge and stakeholder capability, not just tool proficiency.

Milena supports this idea, explaining that: “the biggest challenge we notice as a recruitment agency is matching the right skills: not only technical abilities but also knowledge of the industry. Success in hiring now depends more on understanding the business context than simply knowing the tools.”

This sharpening of expectations is also changing how companies advertise roles. As Milena adds: “from a recruitment point of view, it is positive that organisations are becoming more precise in defining what they really need,” she added. “There are fewer ‘catch-all’ job ads and more focused profiles. This makes hiring smoother: candidates have clearer expectations, and employers achieve better results.”

The downside is that this precision significantly narrows the available talent pool. Many candidates excel with tools but struggle with communication, or communicate well but lack industry depth. Polish employers increasingly want both, and that combination remains hard to find.

Why Data & Analytics Roles Are Strategic Investments in 2025 Poland

Across banking, business services and technology, one trend stands out: even when headcount is constrained, data roles remain protected. In Verita HR’s “War for Talent in Poland in 2025”, employers facing shortages responded by raising salaries or expanding training budgets rather than lowering hiring standards.

The rationale is straightforward. Data capabilities improve margins, reduce risk, and automate core processes. Cutting analytics talent directly weakens competitiveness.

Verita HR’s internal project data further shows that companies rarely hire a single analyst in isolation. Instead, they build small, integrated teams, typically a lead analyst supported by mid-level specialists, and often complemented by a data engineer and a reporting expert. When one strong hire demonstrates measurable value, budgets tend to follow.

As Milena observes, “companies want integrated teams that influence decisions, not just produce reports.”

For candidates, expectations continue to rise. Employers increasingly look for evidence of delivered impact, including cost savings, revenue growth, forecasting accuracy, and risk reduction. Certifications and formal training carry less weight than demonstrable outcomes.

For employers, the message is equally clear. Generic job adverts, vague role definitions, and uncompetitive salary ranges are unlikely to succeed in this market.

How Verita HR Helps with Data and Analytics Recruitment in Poland

Data and analytics recruitment has become one of Verita HR’s fastest-growing practice areas. The team works closely with employers that are scaling data platforms, building AI capabilities, or delivering analytics transformation programmes across Poland.

Verita HR supports employers with salary benchmarking, role scoping, and realistic skills assessment, helping them avoid costly hiring mistakes. Because the team at Verita HR speaks with data professionals daily, they understand both the technical requirements and the business impact of these roles, and they know what strong performance looks like in practice.

For organisations building high performing data teams, timing matters. The supply and demand imbalance continues to widen, and the strongest candidates consistently have multiple options.

Verita HR provides recruitment and workforce solutions including RPO | Permanent Recruitment | Outsourcing | Media Services

Author: Richardson Chinonyerem